rhode island state tax return

Individual income tax return RI-1040. For example if your expected.

Ad Free 2021 Federal Tax Return.

. You can mail your return to the at the correct address below and include your payment by check or money order. The amount of your expected refund rounded to the nearest dollar. To have forms mailed to you please call 4015748970 or email TaxFormstaxrigov.

The Rhode Island Division of Taxation part of the Rhode Island Department of Revenue is open to the public from 830 am. Quickly Prepare and E-File Your 2021 Taxes. Masks are required when visiting Divisions office.

For more information contact the. Ad Download Or Email RI-1040 More Fillable Forms Register and Subscribe Now. RI-1040 Resident Return 2021 Resident Individual Income Tax Return including RI Schedule W - Rhode Island W-2 and 1099 Information and Schedule E - Exemption Schedule PDF file about.

You may check the status of your refund on-line at Rhode Island Division of Taxation. Ad File 1040ez Free today for a faster refund. 2022 Filing Season FAQs - February 1 2022.

Form T-77 must be filed along with Rhode Island estate tax return if the decedent had any interest Real Property or other located in Rhode Island. You may also electronically file your Rhode Island tax return through a tax. Rhode Island State Income Taxes for Tax Year 2021 January 1 - Dec.

Click on the appropriate category below to access the forms and instructions you need. Rhode Island Division of Taxation issues most refunds within 21 business days. Latest Tax News.

The basics of Rhode Island state tax. Head of Household. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only.

File a Tax Return The RI Division of Taxation has multiple ways in which you can file a tax return. If you live in Rhode Island and were required to file a federal income tax return you must also file a state individual income tax return. The Division of Taxation and the State of Rhode Island are.

File Your Tax Return Today. Qualifying widow er RI 1040 H Only. Your social security number.

A resident individual who is not required to file a federal income tax return may be required to file a Rhode Island income tax return if. PPP loan forgiveness - forms FAQs guidance. With the exception of taxes supported by Modernized E-file you.

If you need to change or amend an accepted Rhode Island State Income Tax Return for the current or previous Tax Year you need to complete Form RI-1040 residents or RI-1040-NR. To get to your refund status youll need the following information as shown on your return. File and pay a Sales Tax Return File and pay a Sales Tax Return Please review the terms and conditions for guest returns.

E-File Directly to the IRS State. This form should be filed in triplicate.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Printable Rhode Island Income Tax Forms For Tax Year 2021

Rhode Island Income Tax Calculator Smartasset

Rhode Island Estate Tax Everything You Need To Know Smartasset

1099 G Tax Information Ri Department Of Labor Training

Contact Us Ri Division Of Taxation

Rhode Island Sales Tax Small Business Guide Truic

Rhodeislandtax Rhodeislandtax Twitter

Rhodeislandtax Rhodeislandtax Twitter

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island Income Tax Calculator Smartasset

Rhode Island State Tax Information Support

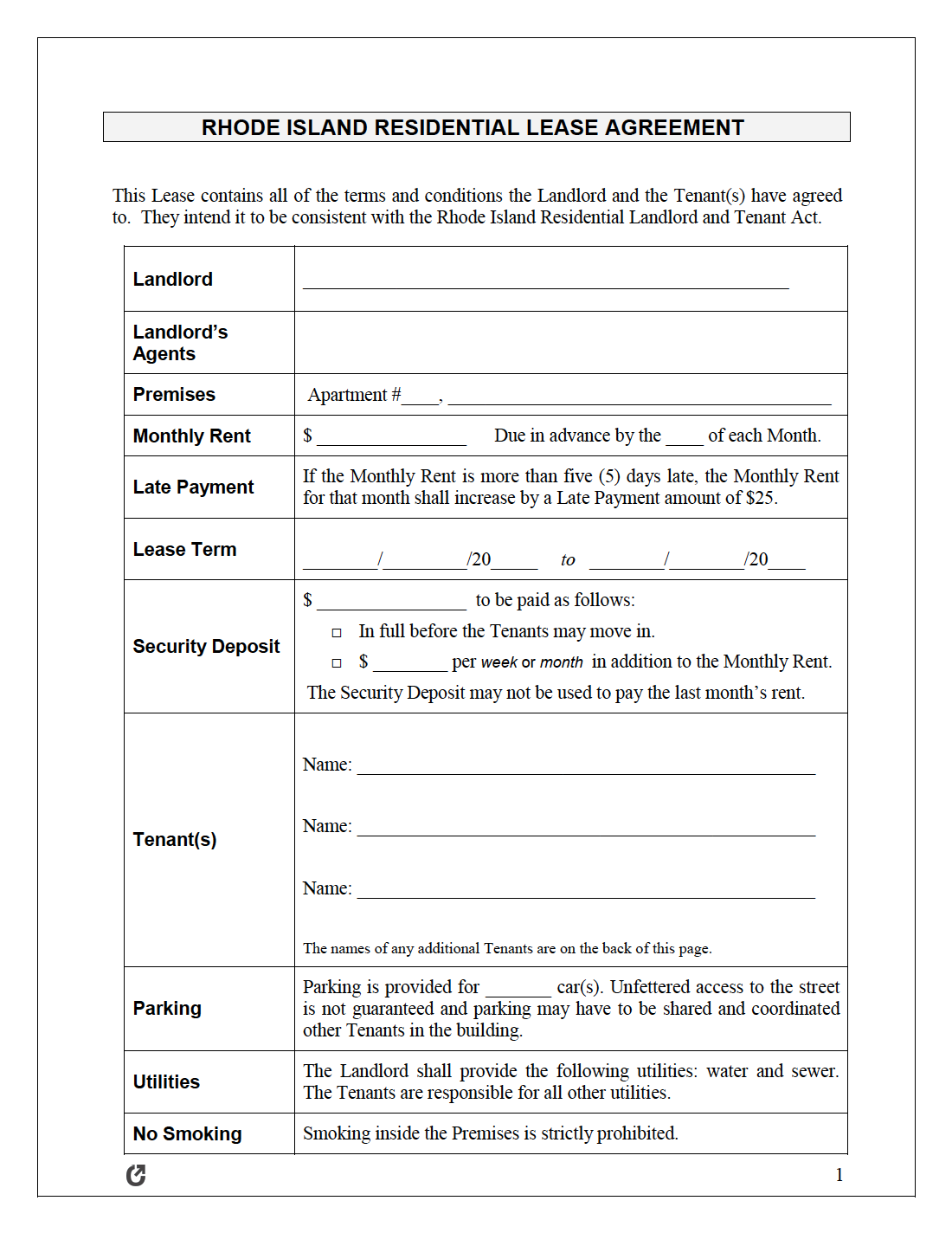

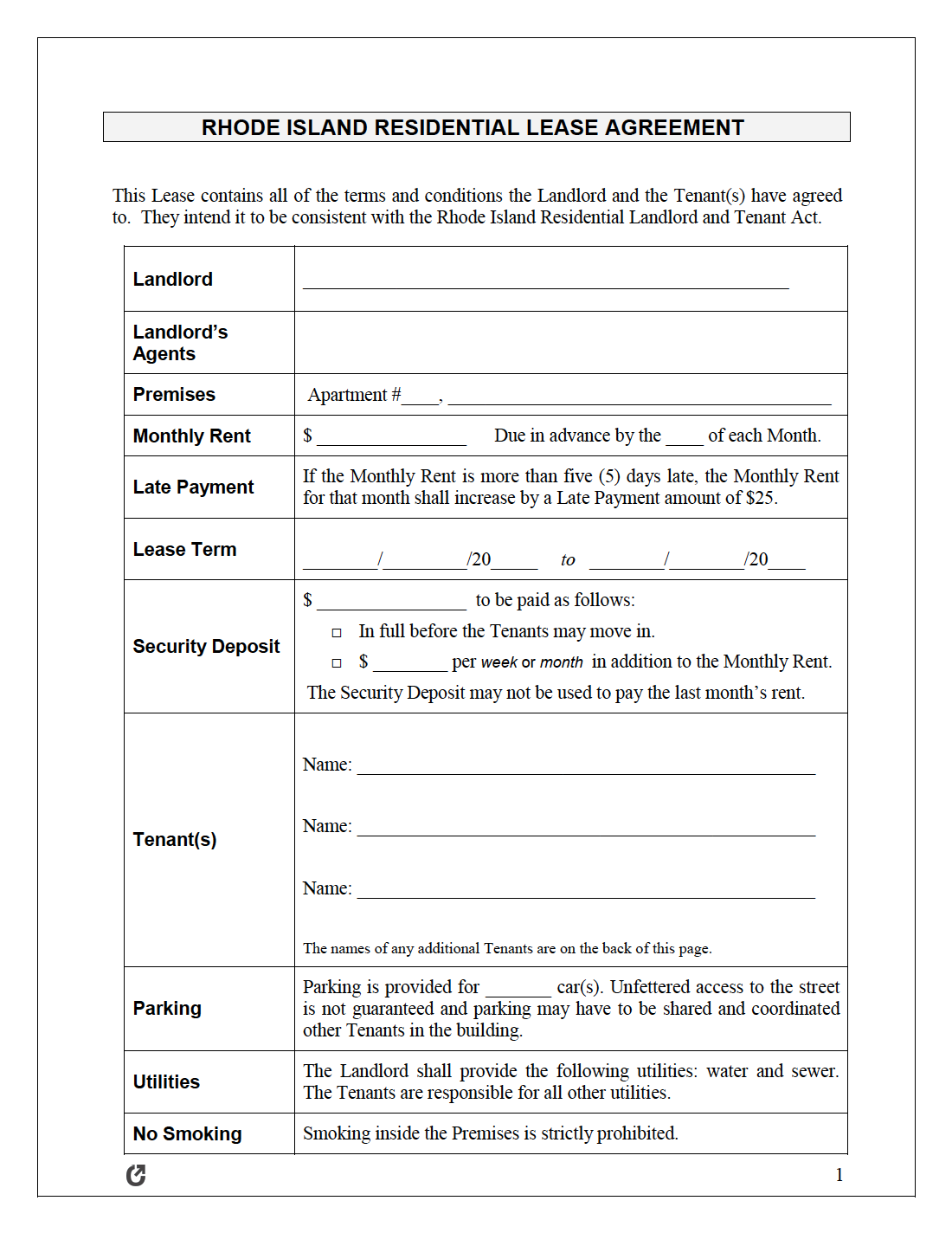

Free Rhode Island Rental Lease Agreement Templates Pdf Word

Prepare And Efile Your 2021 2022 Rhode Island Tax Return